Domestic ore:

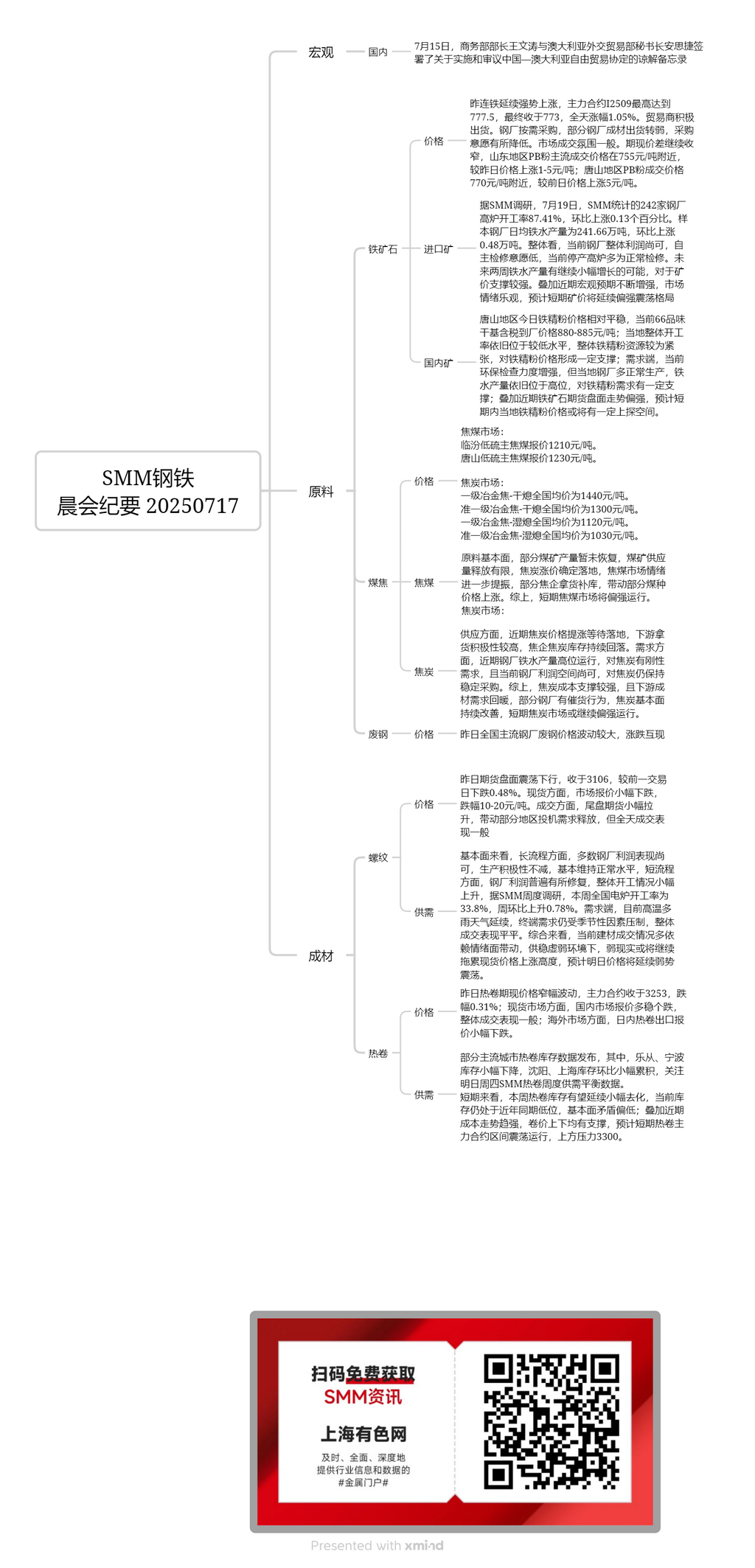

In Tangshan, iron ore concentrate prices remained relatively stable today. The current dry-basis, tax-inclusive delivery-to-factory price for 66% grade iron ore concentrate is 880-885 yuan/mt. The overall operating rate in the local area remains at a relatively low level, and the overall supply of iron ore concentrate is tight, providing some support for iron ore concentrate prices. On the demand side, environmental protection inspections have intensified, but most local steel mills are operating normally, and hot metal production remains high, providing some support for iron ore concentrate demand. Additionally, the recent strong performance of iron ore futures has led to expectations that iron ore concentrate prices in the local area may have some upside potential in the short term.

Imported ore:

Yesterday, iron ore futures continued their strong upward trend, with the most-traded contract I2509 reaching a high of 777.5 and closing at 773, up 1.05% for the day. Traders were actively selling. Steel mills purchased as needed, with some steel mills experiencing weaker sales of finished products and a decrease in purchase willingness. The market trading atmosphere was average. The spread between futures and spot prices continued to narrow. The mainstream transaction prices for PB fines in Shandong were around 755 yuan/mt, up 1-5 yuan/mt from the previous day. In Tangshan, the transaction price for PB fines was around 770 yuan/mt, up 5 yuan/mt from the previous day.

According to the SMM survey, on July 19, the blast furnace operating rate of 242 steel mills surveyed by SMM was 87.41%, up 0.13 percentage points MoM. The daily average hot metal production of the sampled steel mills was 2.4166 million mt, up 0.48 million mt MoM. Overall, steel mills' profits are currently moderate, and their willingness to conduct voluntary maintenance is low. Most blast furnaces that are currently shut down are undergoing normal maintenance. There is a possibility of a continued slight increase in hot metal production in the next two weeks, providing strong support for ore prices. Additionally, with the recent strengthening of macroeconomic expectations and optimistic market sentiment, it is expected that ore prices will continue to hold up well in the short term.

Coking coal:

The quoted price for low-sulphur coking coal in Linfen is 1,210 yuan/mt. The quoted price for low-sulphur coking coal in Tangshan is 1,230 yuan/mt.

On the raw material fundamentals side, production at some coal mines has not yet resumed, and the release of coal mine supply is limited. The increase in coke prices has been confirmed, further boosting market sentiment in the coking coal market. Some coking enterprises have purchased and restocked, driving up the prices of some coal types. In summary, the coking coal market is expected to hold up well in the short term.

Coke:

The nationwide average price for first-grade metallurgical coke - dry quenching is 1,440 yuan/mt. The nationwide average price for quasi-first-grade metallurgical coke - dry quenching is 1,300 yuan/mt. The nationwide average price for first-grade metallurgical coke - wet quenching is 1,120 yuan/mt. The nationwide average price for quasi-first-grade metallurgical coke - wet quenching is 1,030 yuan/mt.

Some steel mills in Hebei and Shandong have accepted the first round of coke price increases of 50-55 yuan/mt, which will be implemented on July 17. In terms of supply, with the recent increase in coke prices waiting to be confirmed, downstream purchase enthusiasm is high, and coke inventories at coking enterprises continue to pull back. In terms of demand, with hot metal production at steel mills remaining high, there is a rigid demand for coke. Additionally, steel mills' profit margins are currently moderate, and they continue to maintain stable purchases of coke. In summary, coke costs provide strong support, and with downstream demand for finished products recovering and some steel mills urging for deliveries, the fundamentals of the coke market continue to improve. The coke market is expected to continue to hold up well in the short term.

Rebar:

Yesterday, the futures market fluctuated downward, closing at 3,106, down 0.48% from the previous trading day. On the spot market, prices fell slightly, with a decrease of 10-20 yuan/mt. In terms of transactions, a slight increase in futures prices at the end of the day drove the release of speculative demand in some areas, but overall trading performance was average.

From a fundamental perspective, in the long process, most steel mills have maintained moderate profits, and their production enthusiasm remains high, basically maintaining normal production levels. In the short process, steel mill profits have generally improved, and the overall operating rate has slightly increased. According to SMM's weekly survey, the national electric furnace operating rate this week was 33.8%, up 0.78% WoW. On the demand side, with the continuation of hot and rainy weather, end-use demand is still suppressed by seasonal factors, and overall trading performance has been mediocre. In summary, the current trading situation of building materials largely depends on sentiment. In an environment of stable supply and weak demand, the weak reality may continue to drag down the spot price increase. It is expected that prices will continue to be in the doldrums tomorrow.

HRC:

Yesterday, HRC futures and spot prices fluctuated rangebound, with the most-traded contract closing at 3253, down 0.31%. In the spot market, domestic market quotes were mostly stable with some drops, and overall trading performance was average. In overseas markets, HRC export quotes dropped slightly during the day. Today, HRC inventory data for some major cities were released. Among them, Lecong and Ningbo saw a slight decrease in inventory, while Shenyang and Shanghai saw a slight accumulation in inventory MoM. Keep an eye on SMM's weekly HRC supply-demand balance data to be released tomorrow, Thursday.

In the short term, HRC inventory is expected to continue to decline slightly this week. Current inventory levels are still at a low point compared to the same period in recent years, and fundamental contradictions are low. Coupled with the recent strengthening trend in cost, HRC prices are supported both above and below. It is expected that the most-traded HRC contract will experience sideways movement in the short term, with an upper resistance level at 3300.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)